On December 22, 2025, Alphabet (GOOG) announced a definitive agreement to acquire Intersect for $4.75 billion in cash, plus the assumption of debt. This news comes as the AI competition landscape shifts from GPU supply constraints to a far more pressing bottleneck: power.

By now, you have likely heard talk of GPUs sitting idle in warehouses. Satya Nadella, CEO of Microsoft, confessed on the Bg2 Pod that his company has cutting-edge GPUs unused because there is nowhere to plug them in. Simultaneously, ambitious ideas are gaining attention, such as building data centers in space, driven by abundant solar power and the absence of cooling constraints. Meanwhile, local communities are pushing back against data center projects due to their heavy consumption of grid power and local water supplies.

These conditions have sparked a new arms race, forcing hyperscalers to secure sufficient power for their data centers. This is what led Alphabet (Google's parent company) to acquire Intersect. Alphabet is in dire need of electricity, as it is now experiencing significant usage growth from its AI endeavors.

Intersect

Intersect solar farm - Radian Solar (Texas)

In simple terms, Intersect develops large-scale power projects, think massive solar plants paired with enormous battery storage systems. Increasingly, they package this infrastructure with data-center power solutions, enabling companies to secure reliable electricity at the scale required for AI and data centers. While they utilize a mix of wind, hydrogen, and gas, their core focus is the combination of solar power and battery storage.

If you're obsessed with stocks and tech like I am, you're probably asking: which battery brand is Intersect using to store all that solar energy?

The answer is Tesla. (This, however, is not the specific opportunity we want to discuss.)

Intersect and Tesla have publicly announced a contract for 15.3 Gigawatt-hour (GWh) of Tesla “Megapack” grid batteries for Intersect’s solar-and-storage portfolio through 2030. This makes Intersect one of the largest buyers and operators of Megapacks, with nearly 10 GWh expected to be deployed by the end of 2027. This partnership helps explain why much of Tesla’s revenue growth this year is coming from energy storage sales while car sales decline.

Now that you understand the context, let's discuss the overlooked company that is an essential player poised to profit significantly from this deal, and from similar future deals as the race to secure energy intensifies.

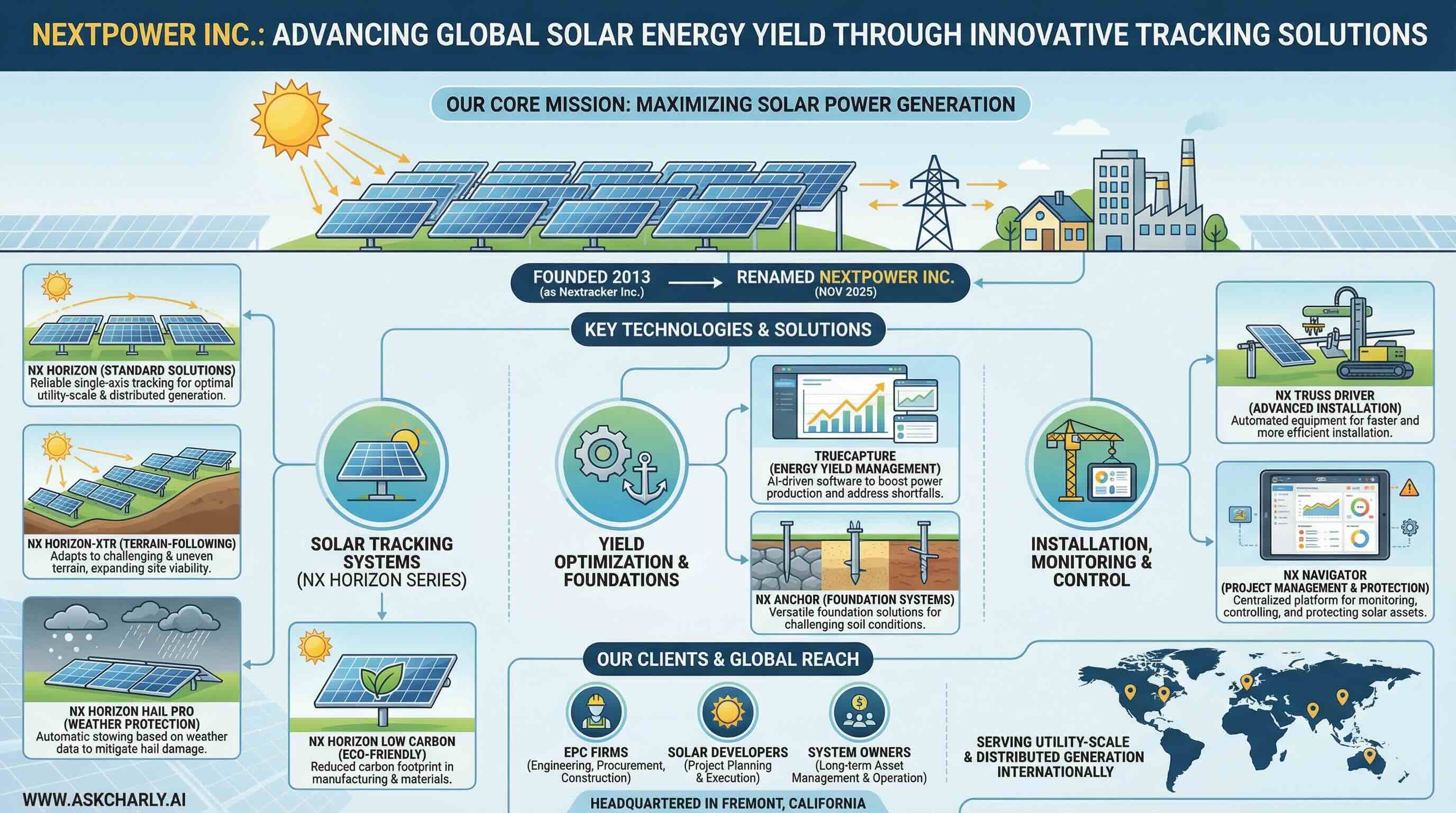

Nextracker Inc (NXT)

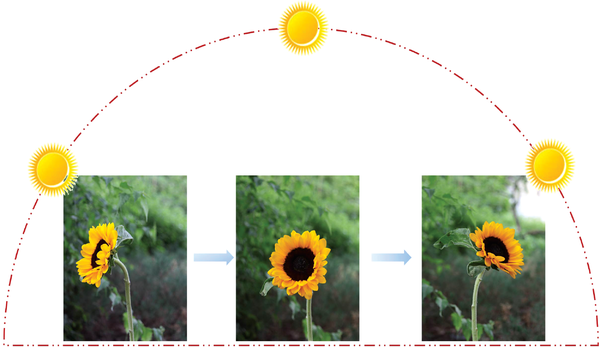

Imagine a field of sunflowers. Throughout the day, their heads turn to follow the sun, soaking up as much light as possible.

Nextracker does exactly that, but for giant fields of solar panels.

They are a leading company that makes smart, rotating mounts (called "trackers") and the software that controls them. These mounts tilt and turn the panels so they are always directly facing the sun, from sunrise to sunset.

Nextracker makes solar panels smarter and more efficient by letting them follow the sun like a sunflower, which generates a lot more clean electricity than if the panels just sat still.

Their main job is to design, manufacture, and provide the technology and software that makes large solar power plants (like the ones being built by Intersect) produce maximum power.

For their big U.S. projects, Intersect uses Nextracker’s single-axis trackers, specifically NX Horizon, and often pairs that with Nextracker’s TrueCapture optimization/control software (e.g., Radian in Texas and Athos III in California).

Intersect solar farm - Athos III (California)

Business Performance

For Q3, Nextracker reported revenue of $905.3 million, a 42% increase from the same period last year. This growth was driven by a 41% increase in gigawatts delivered, especially in the U.S., and additional revenue from recent acquisitions. Gross profit rose 30% to $292.9 million. With a strong cash position of $845.3 million, versus an approximate total debt of $144.5 million, indicating the company debt balance sheet as of September 2025. The company’s profitability is supported by strong demand, successful cost management, and the benefit of U.S. manufacturing tax credits, but faces pressure from rising tariffs and increased operating expenses due to expansion and acquisitions.

Strategically, Nextracker is expanding globally and enhancing its offerings through acquisitions and a new joint venture in Saudi Arabia. These moves are designed to drive growth, improve efficiency, and solidify the company's position as a leader in integrated solar solutions.

Bull Case

Nextracker (NXT) is that it is a prime beneficiary of the AI-driven surge in power demand, which urgently requires more utility-scale solar. NXT sells essential "picks-and-shovels" tracking systems for these projects, giving it exposure regardless of which tech company wins. Its competitive moat is built on a superior, bankable product that maximizes energy yield, critical when power is scarce, and software that adds value and margin. This demand is accelerated by AI but remains durable due to underlying trends like grid modernization and electrification, positioning NXT to win market share as solar scales.

Bear Case

The bear case for Nextracker centers on risks that the projected solar boom may not materialize as expected or that NXT's advantages could erode. Key concerns include: a sharp slowdown in solar project starts due to high interest rates (which are now declining), interconnection delays, or policy shifts; intense price competition commoditizing its tracker hardware; and execution risks from supply chain (steel, tariffs) or logistics.

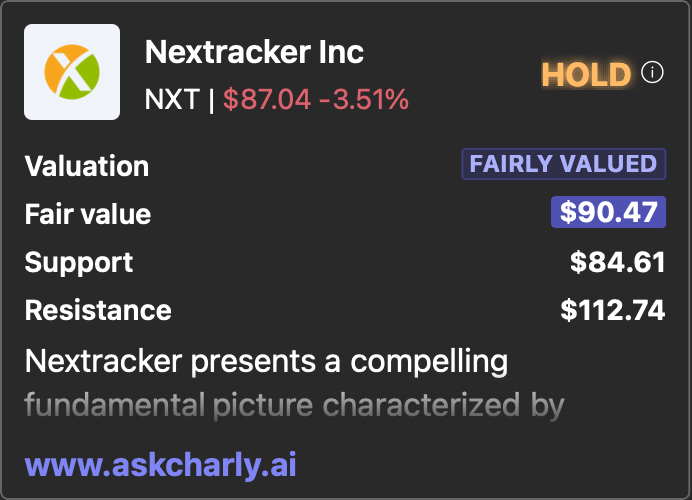

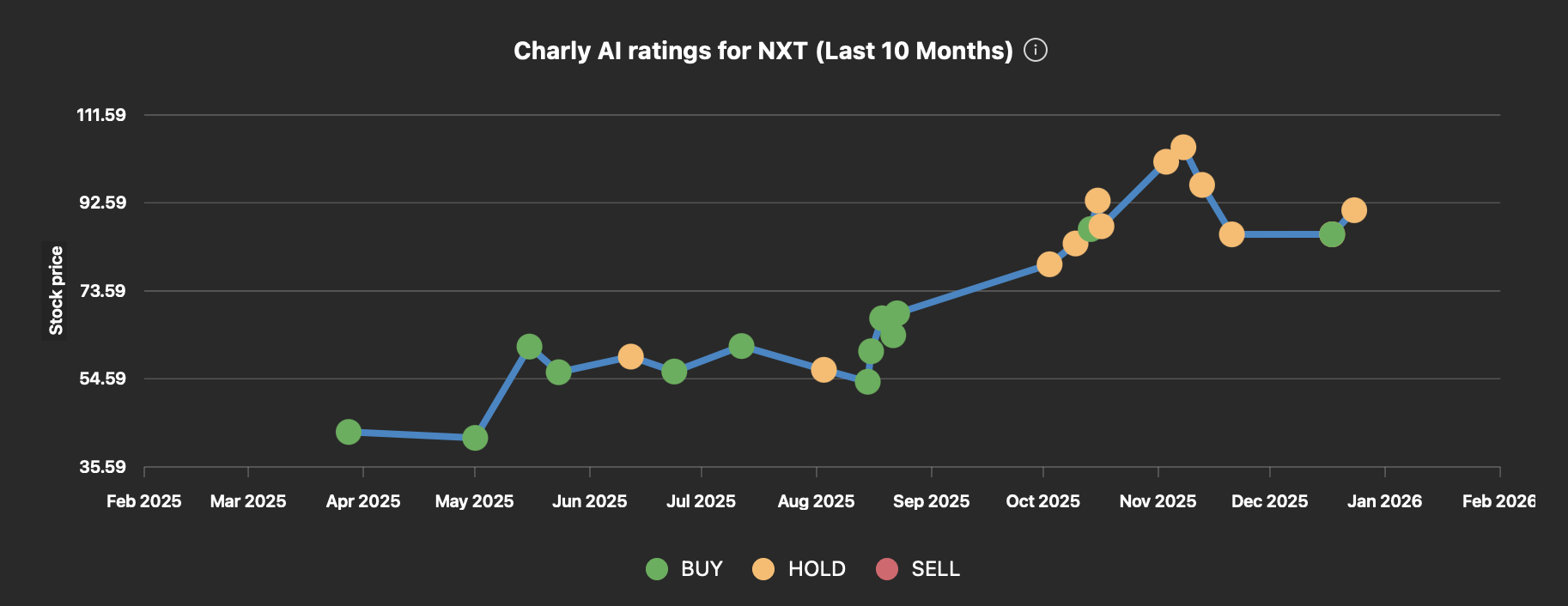

My NXT Position

Year to date, NXT stock is up 120%. I originally established a position in June, when the stock was trading around $60, based on Charly AI report. At the time I was not even aware of the Intersect deal. Looking back, my main regret today is not being more aggressive with my initial purchase. However, I am slowly building up my position.

As you can see from the last 10 months ratings, from April to September, Charly AI maintained a BUY rating with each re-analysis as the stock rose from ~$36 to ~$74.

PS: The Charly AI research agent continuously monitors and re-analyzes stocks, updating its BUY, HOLD, or SELL rating whenever a stock's price moves by plus or minus 5%. Each update includes a refreshed explanation highlighting what changed, whether in price, fundamentals, or recent news.

If you enjoyed this, please consider subscribing and liking. Some of my newsletter content is reserved for paying subscribers. By subscribing, you can follow my investment journey from building my AI research assistant, "Charly", to making real investments based mainly on its analysis. Thank you for being part of this journey.

- Charly AI’s analyses and ratings are AI-assisted and for educational purposes only.

- Not investment, legal, or tax advice, and not a solicitation or recommendation to buy, sell, or hold any security.

- Charly AI is not a broker-dealer or registered investment adviser and does not provide personalized advice or act as a fiduciary.

- Information may rely on third-party sources, market data and SEC filings believed reliable, but accuracy and completeness are not guaranteed and content may be incomplete or outdated.

- Past performance is not indicative of future results.

- Investing involves risk, including loss of principal.

- Consider your objectives and consult a qualified advisor before acting.